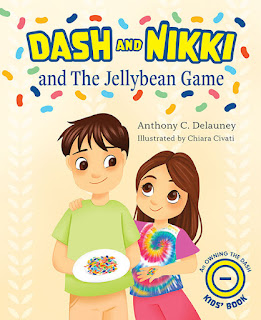

Anthony C. Delauney is the author of the new children's picture book Dash and Nikki and the Jellybean Game. His other books include the forthcoming The No-Regrets Retirement Roadmap. He is a financial advisor and business owner.

Q: The Kirkus Review of Dash and Nikki says, “Featuring a kid-friendly game, Delauney’s engaging tale depicts the importance of creativity and a resourceful solution. The story features a relatable, positive display of sibling camaraderie.” What do you think of that description?

A: I love the description because it highlights that the book is about more

than teaching a basic financial lesson. It dives deep into the emotions of how

we as children (and as adults) can feel and react when we make certain

decisions.

The book opens with a loving sister who can’t wait to tell her brother about a special surprise. She waits to open the letter with him instead of tearing it open as soon as she finds it. She is also excitedly leaning over his shoulder listening as he reads the note to everyone.

But when the game is presented, the playfulness and kindness of the brother and sister are tested as they see the need to compete with one another to get the most jellybeans.

Money can elicit the same emotions and reactions. It can be fun to start making

money or to receive it, but as adults we know that it is also very easy to get

caught up in trying to have more than someone else. Money gives us some skewed

sense of status or personal self-worth.

As the story continues, we see that Nikki is more emotional and impulsive with her jellybeans. She originally wants to win, but then she eats them almost immediately.

Her reaction shows how emotions can wreak havoc on our decision-making skills. We often create logical game plans in our minds for dealing with money or health, but as soon as emotions kick in, we sabotage ourselves.

Dash is also aware that his emotions can influence his decisions, so before they do, he comes up with a plan to control the emotions. He hides his beans. He knows that they are there, but just the act of hiding them helps him take control of the situation.

Money is much easier to manage when it has specific, assigned purposes and is

separated out according to each purpose. Having all dollars—or jellybeans—at

your fingertips is awfully tempting.

It’s the reason that many financial advisors caution against having too much money sitting in an easily accessible checking account. The easier it is to access, the more likely it is to get used for the wrong reasons.

I especially love the recognition of sibling camaraderie, because it highlights the importance of the third most critical foundation of money. We often discuss important lessons in spending and saving, but what we tend to overlook is the importance and value of giving.

Individuals who are superstars with controlling their budgets and future savings often find it difficult to determine how much to give and how best to give. There is the constant fear of never having enough or seeing the money run out. As a result, many millionaires and billionaires spend their entire lives just accumulating wealth.

If children and young adults can learn the basic principles required to take control of their financial lives and achieve financial stability as adults, they can then redirect their focus on how to improve not only their lives but also the lives of those around them in a way that aligns with their passions and their values, just as Dash found a way to help his sister in the end.

Q: What do you think Chiara Civati's illustrations add to the story?

A: Chiara did an incredible job of conveying the emotions that Dash and Nikki experience throughout the book.

One of the most critical lessons I learned when writing a children’s picture book is that you should never tell the reader what the character is feeling. Instead, you should describe the situation and actions and allow the reader to interpret the mood of the character.

Chiara gave Dash and Nikki and their parents life! She turned them from simple sketched characters into a family we could understand and relate to.

Her use of bright and playful colors matches well with the jellybean theme and makes the book welcoming and fun for young readers. The illustrations on each page also allow readers the opportunity to see all sorts of detail in the backgrounds, but are not so clustered that it becomes hard for children to read along with their parents.

My children, Abbie and Jason, agree that their favorite picture in the book is on the page where Nikki gulps down her jellybeans. Her carefree attitude is incredibly well presented, and Dash’s shocked reaction makes Abbie and Jason laugh every time that they see it.

Chiara made the children’s book come to life, and she will play a major role in future Owning the Dash Kids books. We can’t wait to share what we have in store for 2022!

Q: What do you hope kids take away from the book?

A: I hope that after children read the book, when they are presented with important decisions involving a choice between a small gratification now and a larger reward later, they will reflect on Dash and Nikki’s story and take some time to consider their decision.

I hope that they learn that winning does not always have to involve beating someone else and that two or more people can win at the same game.

I hope that when a child has an abundance and sees someone else in need, they will think of how Dash helped his sister and both ended up happy in the end.

I hope that as young parents read this story to their children, they reflect on their own long-term goals and dreams. Perhaps they will take a moment to ask themselves whether they are on track to achieve those dreams or are allowing short-term emotions and impulses to cloud their judgement.

Finally, I hope that Dash and Nikki and the Jellybean Game becomes a valuable tool that teachers use to educate students across the country on the importance of critical thinking, delayed gratification, patience, compassion, and empathy.

Q: What are you working on now?

A: Dash and Nikki and the Jellybean Game is the first children’s picture book in the Owning the Dash Kids series. In June/July 2022, I will release the next book in the series called Lilly and May Learn Why Mom and Dad Work. This new book will involve another loving family and will help teach the important lesson of why moms and dads have to go to work.

I still can remember looking back at my daughter, Abbie, when she was about 4 years old, and seeing her crying uncontrollably as I walked out the door to leave for the office. She and my son, Jason, could not understand why I couldn’t stay home and play for the day.

For every parent who needs to have this difficult discussion with their own kids, my new Owning the Dash Kids book will be a conversation tool to help make the process a bit easier.

Q: Anything else we should know?

A: In April 2022 I will release my next book in the financial self-help category: The No-Regrets Retirement Roadmap.

My original 2019 self-help book, Owning the Dash: Applying the Mindset of a Fitness Master to the Art of Family Financial Planning, focused on helping young couples and families learn the essentials of financial planning to start taking control of their financial lives. The No-Regrets Retirement Roadmap shifts the focus to older adults preparing for the critical transition into retirement.

The few years immediately before and after retirement are critical; proper decision-making is essential to ensuring a comfortable and secure retirement. Proper planning can lead to immense long-term savings and steady cash flow, while poor planning will likely lead to big regrets.

The No-Regrets Retirement Roadmap is meant to be exactly what the title says: a roadmap to avoiding those regrets and enjoying the next phase in your life journey.

It guides you through making the most important decisions of your mature life, from defining your retirement dreams to establishing a flexible budget, getting the most out of Social Security, minimizing taxes, and protecting your health and investments.

Handy charts and checklists take you through the process step by step, making even the scariest questions—What if major home or health expenses arise after I retire? What insurance and investment strategies fit my needs? Do I really have enough money?—easy to approach and answer.

More information about the book is available at www.owningthedash.com.

--Interview with Deborah Kalb

No comments:

Post a Comment